Sex and money, not just the premise of most television shows these days. Sex and money are also the core (or so they say) of the arguments most married couples ever have…and end up divorced over. True as that might be, I think there are many more problems in between the two issues that can accelerate the expiration date on your marriage.

But let’s start with money.

I have opened up about money issues before here , there, and here but this is still one of the most common email questions we receive and a number of our readers have asked us to talk about it.

I initially thought about discussing some of the topics that seem to obsess Nigerian social media on a weekly basis, such as:

“Should a boyfriend pay for you to go and eat Jibowu pancakes with another man?”

“Would you date a man who rides public transport to work?”

“Should you date a man who can’t buy a car for you as assurance?”

“30k runs, worth it or not?”

But then I realized that most of my readers are not 15 year olds pretending to be 25 year olds on the internet and therefore may prefer to hear something a bit more realistic. No shade to young people, but seriously….greater issues await you.

So here is a complete breakdown of how we handle money in our marriage. Keep in mind the following as you read.

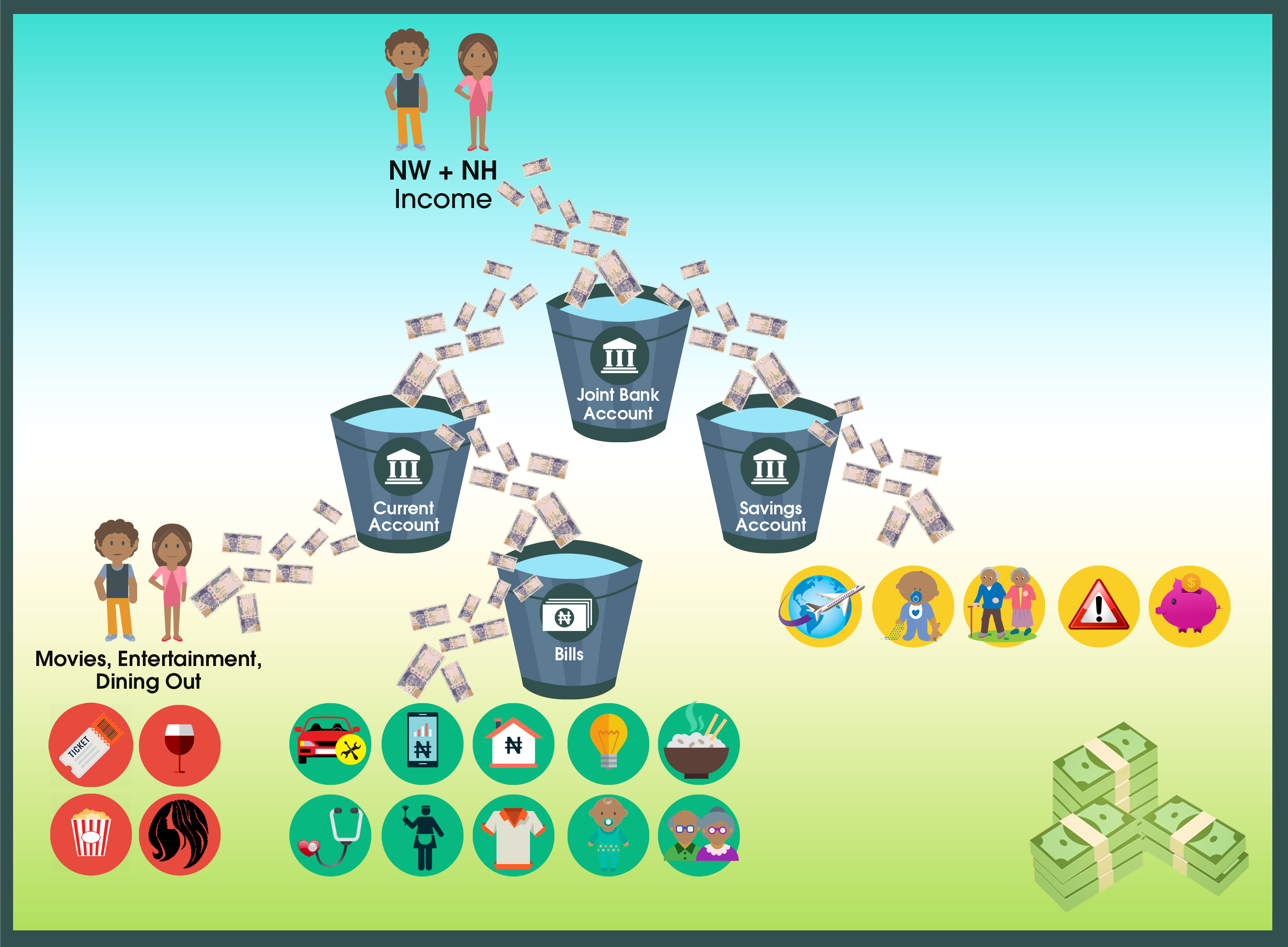

1) My wife and I are big believers in acting as ONE when it comes to everything. Including finances. This is why we utilize the concept of joint money and pooled funds. We set our financial goals before we got married and have revised them as life progressed. We learned this concept during pre-marital counseling and have found it to be the simplest method and most effective method for us to handle our finances without any major arguments. You all know that she and I have plenty of other things we argue about so I am not bragging by any means. But this is one area of life I can testify about. I know for sure that if I hadn’t joined hands with my wife, we’d be separately poor, rather than jointly well off. Moreover, it’s made us accountable to each other and to God, and practicing accountability has many positive consequences for us. Many couples do it differently, but this is how we do it.

2) As I’ve explained before…YES, my wife knows what I earn and vice versa. I wouldn’t be commingling funds with someone I didn’t trust.

3) NO we do not ascribe to the belief that a woman is not responsible for her family’s upkeep, and contrary to what some of the cast members of BKChat London might think, we do not agree that “a woman is an expense.” To the contrary, she is an asset.

4) The diagram below is just to show you a simplified version of our overall flow. The actual amounts depicted do not matter. Nor does the diagram take into account more complicated items such as income from various investments and properties.

Now, because we had a number of very specific requests from readers in the UK, asking us to break our budget down using actual figures, and to also show what would happen in a situation where only one spouse is earning any income, I am including some charts below. The numbers are made up. I repeat. Made Up. So kindly revise as you see fit for your own specific situation. In short, please don’t get upset if I’ve projected a number that is unrealistic for your situation/country/setting. Moreover, given that the Nigerian currency has been possessed by an evil spirit, doing this chart in a smaller currency like GBP was easier, so that I can depict thousands, rather than millions. Disclaimers aside, the same logic applies no matter what currency you’re dealing with, how much you are earning, or who is earning more.

Scenario 1

[table id=1 /]

Scenario 2

[table id=2 /]

So there you have it. Sample budgets and flow charts to give you a bird’s eye view into how we make our marital finances work. I have just used some very loose numbers here but again, everyone’s situation (be you a chef in London, a Matatu driver in Nairobi, a politician in Abuja, or an instagram model in Pretoria) is different. As always, questions welcome below or via AskNaijaCouple.

Next Post….Sex.

Leave a Reply