Read Part 1 of Chop My Money for some context

___________________________________________

The way I grabbed NaijaWife and bolted out of the building, the restaurant must have thought I had diarrhea.

Ruminating over the information she’d given me, I kept silent in the car headed to her house after our short dinner. I dropped her off without a word and went home, still deep in thought.

I had to really think on this one. Running some calculations in my head, I asked myself, how many years would it take to pay that off? How would we live if she didn’t find work as well? If she alone paid that debt how long would it take her to pay it? What would they do to her if she didn’t pay it?

That night I didn’t call her as was my usual practice. (Later she would tell me she thought my silence was a sign that I was going to end things with her). Instead I stayed up late, creating an excel sheet. Forecasting expected interest over the next 5, 10, 20 years, what would be the expected final payment? I realized that if she didn’t pay it off quickly, the debt would balloon. But to pay it off within a few years would require cash. Heavy cash.

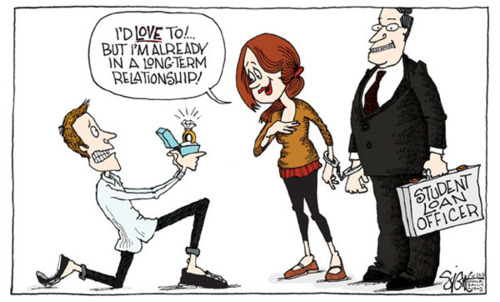

Few things can make you question your commitment to someone more…than the thought that you might be taking on their debt.

You may have already guessed that it was educational debt. This kind of debt might not be a problem most Nigerians consider before embarking on relationships, as they’re usually too busy worrying about genotypes. But it’s something that Nigerians like NaijaWife, who sought a graduate degree in the U.S., have to face as their reality. (If you’d like to learn more about this issue try reading this Wall Street Journal article here and check out Relentless Builder’s cover of the topic here)

Despite great scores, she’d only been given a partial scholarship and was told by the school that it was their standard policy to include loans in every student’s financial aid package to cover all remaining costs. They convinced her that she was “certain” to get a nice job after graduating that would help her to pay off the private loan in “no time”. Knowing she didn’t have rich parents or relatives to turn to for the money to attend, and hearing the same story from the other schools she’d been accepted to, she had little choice but to believe their explanation that the loan wouldn’t be that hard to pay off at the end of the program.

But….

NaijaWife soon began to panic about just how bad the debt would be when, on the first day of classes, they were herded into a room for a mandatory “financial counseling” session. As they sat around anxiously, a tall, sober looking man carrying a dark briefcase, walked to the front of the room and paced around for five minutes without saying a word.

“First of all..” He began. “Let me congratulate you on your acceptance into this school. Only 8% of all applicants were accepted into this program. You are in this room now because you were one of the chosen few. You are also in this room because you’ve had to take a loan to attend this school and probably have no idea what that means.”

“Well do not be dismayed. I am going to tell you how to live economically until you pay off your loans.”

Then he opened his briefcase, and took out a plastic sandwich bag.

“This sandwich bag is your new best friend. Take one everywhere you go. And when I say everywhere, I mean do not leave home without it. Keep one in your pocket or in your purse. You will soon notice that on this campus, there will be many special events held where meals will be served. Carry this around so that anytime you see food, you can put it inside. This way, you will save money on groceries. The more money you save, the quicker you can pay off your loans.”

Everyone in the room was stunned. Some started laughing nervously but…being who she is, NaijaWife sharply raised her hand and asked: “What if you’re not invited to that event?”

“Learn to move quickly on your feet.” he replied.

When he spent the next 10 minutes handing out free sandwich bags to the students in the room, NaijaWife realized she had exchanged ASUU wahala for American gbese.

So she spent her time at the school worming her way into every random event she could. Be it the “Secret Ninja Assassin’s” annual gala, the “People Watching Club” weekly meeting, or the board elections for the “Society of Anonymous Feminists”, you’d usually find her in the back corner of the room by the food table, stuffing goodies into her bag.

Well…hungry, broke and debt ridden she still graduated and carried her foreign degree back to Nigeria, where jobs are hard to find and the salaries couldn’t come close to what she needed to clear the loans…and as her debt gained more interest, her panic increased.

Fast forward to the time we started dating seriously when, rather than hide the facts about her crushing debt, she wanted me to know the truth.

When she whispered the figure to me that night, my first thoughts were that if we broke up I wouldn’t have to pay it. But if we stayed together and got married, then there was no doubt that my hard-earned money would go into that seemingly endless pit. I’d always dreamt of retiring at 40, but if I took her debt on that dream would fade away. If I let her go, my other dream of spending the rest of my life with her would also disappear.

Well, you already know what choice I made.

You also already know that NaijaWife was the number one Efiko of our pre-engagement counseling class. So on the day when they covered the unit of money, and the pastor asked “Who do you think is in charge of providing for the family?” NaijaWife’s hand shot straight up into the air.

“Ooooohh! Pick me ! Pick me! Pick me!” As she danced above her seat. As usual, she was the only one volunteering so she was the only one they called on.

After the pastor nodded to her to respond, NaijaWife stood up slowly, straightened her blouse, and answered:

“The husband.”

Then she turned back to me, smiling coyly.

“Wrong.” – replied the Pastor

And the smile on NaijaWife’s face disappeared.

_________________

Oh did you think that part 2 was the end? Well, watch out for the final installment (we promise) this week. Part 3 of Chop My Money.

Leave a Reply